An accounts receivable specialist job description outlines the roles and responsibilities of a professional responsible for managing and tracking a company’s accounts receivable. This position plays a crucial role in ensuring timely payments from customers, maintaining accurate financial records, and optimizing cash flow.

The importance of this role lies in its direct impact on a company’s financial health. Effective accounts receivable management improves cash flow, reduces bad debts, and provides valuable insights into customer payment patterns. Historically, this function was primarily manual, but technological advancements have led to the adoption of automated systems, enhancing efficiency and accuracy.

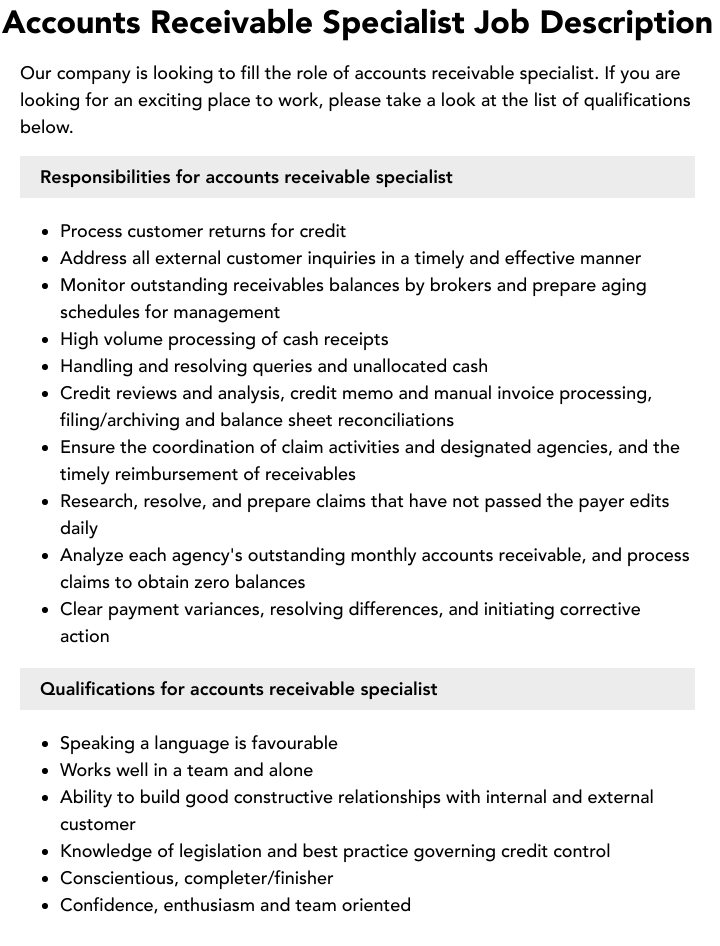

The main article topics will delve into the specific duties and responsibilities of an accounts receivable specialist, including:

- Processing and recording customer payments

- Managing accounts receivable aging reports

- Resolving customer inquiries and disputes

- Collaborating with other departments, such as sales and customer service

- Identifying and mitigating potential credit risks

1. Processing and recording customer payments

Within the context of an accounts receivable specialist job description, processing and recording customer payments is a fundamental responsibility. It serves as the foundation for accurate and timely accounts receivable management, ensuring the smooth flow of cash into the business. Accurate processing and recording of payments allow companies to maintain a clear and up-to-date record of their financial transactions, which is essential for making informed business decisions.

Inefficient or inaccurate payment processing can lead to delays in cash flow, errors in financial reporting, and strained customer relationships. For instance, if a payment is not recorded promptly, it may not be reflected in the company’s financial statements, leading to an incorrect representation of the company’s financial position. Similarly, if a payment is recorded incorrectly, it could result in over or under-billing customers, causing confusion and potential disputes.

Effective processing and recording of customer payments require a combination of attention to detail, proficiency in accounting software, and a commitment to accuracy. Accounts receivable specialists must have a strong understanding of the company’s payment policies and procedures to ensure that payments are handled consistently and efficiently. They must also be able to identify and resolve any discrepancies or errors that may arise during the payment process.

2. Managing accounts receivable aging reports

Managing accounts receivable aging reports is a crucial aspect of an accounts receivable specialist job description. It involves monitoring the age of outstanding invoices, identifying overdue payments, and taking appropriate actions to collect them. This process is essential for maintaining healthy cash flow and minimizing bad debts.

- Identification of overdue payments: Accounts receivable specialists analyze aging reports to identify invoices that are past their due dates. This enables them to prioritize collection efforts and focus on the most critical accounts.

- Collection strategies: Based on the aging of the overdue invoices, accounts receivable specialists develop and implement appropriate collection strategies. These strategies may include sending reminder notices, making phone calls, or initiating legal action.

- Customer communication: Managing accounts receivable aging reports also involves communicating with customers regarding overdue payments. This includes explaining the situation, discussing payment options, and negotiating payment plans if necessary.

- Reporting and analysis: Accounts receivable specialists track and report on the status of overdue payments. This information is used to evaluate the effectiveness of collection efforts and identify areas for improvement.

By effectively managing accounts receivable aging reports, accounts receivable specialists play a vital role in ensuring timely payments from customers, maintaining positive customer relationships, and optimizing cash flow for the business.

3. Resolving customer inquiries and disputes

In the context of an accounts receivable specialist job description, resolving customer inquiries and disputes plays a critical role in maintaining positive customer relationships, minimizing bad debts, and preserving the company’s reputation. This responsibility involves handling a wide range of customer concerns, from simple inquiries to complex billing disputes.

- Inquiry management: Accounts receivable specialists respond to customer inquiries regarding invoices, payments, account balances, and other billing-related matters. They provide clear and accurate information, ensuring that customers have a thorough understanding of their account status.

- Dispute resolution: When customers dispute charges or invoices, accounts receivable specialists investigate the matter, gather relevant documentation, and work towards a mutually acceptable resolution. They assess the validity of disputes, negotiate payment arrangements, and maintain a professional and courteous demeanor throughout the process.

- Customer communication: Effective communication is paramount in resolving customer inquiries and disputes. Accounts receivable specialists communicate clearly and respectfully with customers, explaining policies and procedures, discussing payment options, and addressing concerns in a timely and empathetic manner.

- Documentation and reporting: Accounts receivable specialists maintain detailed records of all customer inquiries and disputes. This documentation includes notes on conversations, summaries of resolutions, and any supporting evidence. They also report on the volume and nature of inquiries and disputes, providing valuable insights for process improvement.

By skillfully resolving customer inquiries and disputes, accounts receivable specialists contribute to the overall customer satisfaction, strengthen the company’s relationships with its clients, and uphold the integrity of the accounts receivable process.

4. Collaborating with other departments

Collaboration with other departments is a vital aspect of the accounts receivable specialist job description. Effective coordination and information exchange among different departments are crucial for the smooth functioning of the accounts receivable process and the overall financial health of an organization.

The accounts receivable specialist acts as a bridge between the finance department and other departments, such as sales, customer service, and shipping. By working closely with sales, the specialist can gain insights into customer orders, expected payment dates, and any potential discounts or promotions that may impact accounts receivable. This information helps in accurately recording and tracking customer invoices.

Collaboration with customer service is essential for resolving customer inquiries and disputes related to invoices and payments. The accounts receivable specialist can provide customer service representatives with up-to-date account information, payment history, and any outstanding balances. This enables customer service to effectively address customer concerns and maintain positive relationships.

Coordinating with the shipping department ensures that accurate and timely shipping information is available for invoicing purposes. The accounts receivable specialist can track the status of shipments and reconcile them with customer orders to ensure that invoices are sent promptly and accurately.

Effective collaboration among departments streamlines the accounts receivable process, reduces errors, and improves overall efficiency. By fostering open communication and maintaining strong relationships with other departments, accounts receivable specialists contribute to the financial success and reputation of the organization.

FAQs on “Accounts Receivable Specialist Job Description”

This section addresses frequently asked questions (FAQs) related to the job description of an accounts receivable specialist. These FAQs aim to provide concise and informative answers to common concerns or misconceptions surrounding this role.

Question 1: What are the primary responsibilities of an accounts receivable specialist?

Answer: Accounts receivable specialists are responsible for managing and tracking a company’s accounts receivable, ensuring timely payments from customers, maintaining accurate financial records, and optimizing cash flow. Their duties include processing and recording customer payments, managing accounts receivable aging reports, resolving customer inquiries and disputes, collaborating with other departments, and identifying and mitigating potential credit risks.

Question 2: What qualifications are typically required for an accounts receivable specialist role?

Answer: Typically, accounts receivable specialists possess a high school diploma or equivalent and have experience in accounts receivable or a related field. They should have strong accounting skills, proficiency in accounting software, and excellent communication and interpersonal skills. Additionally, a bachelor’s degree in accounting or a related field may be preferred.

Question 3: What is the career outlook for accounts receivable specialists?

Answer: The job outlook for accounts receivable specialists is expected to grow in the coming years due to the increasing demand for skilled professionals who can effectively manage accounts receivable and ensure timely payments. This growth is driven by the rising complexity of business transactions and the need for businesses to optimize their cash flow.

Question 4: What are the key skills and competencies required for success as an accounts receivable specialist?

Answer: Successful accounts receivable specialists possess a combination of hard and soft skills. Hard skills include proficiency in accounting principles, financial analysis, and accounting software. Soft skills include strong communication, interpersonal, and problem-solving abilities, as well as an eye for detail and accuracy.

Question 5: What career advancement opportunities are available for accounts receivable specialists?

Answer: With experience and additional qualifications, accounts receivable specialists can advance to roles such as accounts receivable manager, credit manager, or financial analyst. Some may also pursue further education to enhance their career prospects and qualify for more senior positions within the finance or accounting.

Question 6: What industries employ accounts receivable specialists?

Answer: Accounts receivable specialists are employed in various industries, including manufacturing, retail, healthcare, technology, and non-profit organizations. They play a vital role in ensuring the financial health and smooth operation of companies across different sectors.

These FAQs provide insights into the key aspects of an accounts receivable specialist job description, helping individuals understand the role’s responsibilities, qualifications, career outlook, and essential skills. By addressing common questions, this section aims to clarify any misconceptions and provide a comprehensive overview of this important finance and accounting position.

For further information or to explore accounts receivable specialist job opportunities, refer to the next section of the article.

Tips for Accounts Receivable Specialists

For individuals seeking success in accounts receivable specialist roles, consider implementing the following tips:

Tip 1: Develop strong accounting skills

Maintain a thorough understanding of accounting principles, financial analysis, and industry best practices. This foundation will enable you to accurately process and manage accounts receivable transactions.

Tip 2: Enhance communication and interpersonal abilities

Foster effective communication with customers, colleagues, and other stakeholders. Clear and timely communication is crucial for resolving inquiries, managing disputes, and maintaining positive relationships.

Tip 3: Master accounting software and technology

Gain proficiency in accounting software and leverage technology to streamline processes, improve accuracy, and enhance efficiency in accounts receivable management.

Tip 4: Stay updated with industry regulations and trends

Keep abreast of industry regulations, accounting standards, and emerging trends. This knowledge will ensure compliance and enable you to adapt to evolving business practices.

Tip 5: Embrace continuous learning and professional development

Engage in ongoing learning opportunities, such as workshops, seminars, or online courses. Continuous professional development will enhance your skills and knowledge, making you a more valuable asset to your organization.

Tip 6: Cultivate a detail-oriented and analytical mindset

Maintain a high level of accuracy and pay meticulous attention to detail. Analytical skills will help you identify trends, patterns, and potential risks in accounts receivable management.

Tip 7: Build strong relationships with customers

Establish and maintain positive relationships with customers. Understand their needs, address their concerns, and strive to provide excellent customer service.

Tip 8: Stay organized and manage time effectively

Develop effective organizational and time management skills. Prioritize tasks, meet deadlines, and maintain a well-organized workspace to ensure efficiency and accuracy in your daily responsibilities.

By incorporating these tips into your approach, you can enhance your effectiveness as an accounts receivable specialist and contribute to the financial success of your organization.

As you continue your professional journey, remember the importance of adaptability, continuous learning, and a commitment to excellence. These qualities will serve you well in navigating the dynamic and challenging field of accounts receivable management.